| |

|

|

Dear Professional Colleagues,

|

|

Greetings of the Day !

Ministry of Finance had issued a Press release dated July

1st, 2023, regarding gross GST revenue.

Highlights

The gross GST revenue

collected in the month of June 2023 is Rs 1,61,497 crore of

which,

- CGST is ₹ 31,013 crore,

- SGST is ₹ 38,292

crore,

- IGST is ₹ 80,292

crore (including ₹ 39,035 crores

collected on import of goods) and

- Cess is ₹ 11,900

crore (including ₹ 1,028

crores collected on import of goods).

- ₹1,61,497

crore gross GST revenue collected for June 2023; records 12% Year-on-Year

growth

- Gross

GST collection crosses ₹1.6 lakh crore mark for 4th time since inception

of GST; ₹1.4 lakh crore for 16 months in a row; and ₹1.5 lakh 7th times

since inception

- Average monthly gross GST collection for Q1 of

FY2021-22 is ₹1.10 lakh crore; FY2022-23 is ₹1.51 lakh crore; and

FY2023-24 is ₹1.69 lakh crore

The government has settled ₹36,224 crore to CGST and ₹30269

crore to SGST from IGST. The total revenue of Centre and the States in the

month of June 2023 after regular settlement is ₹67,237 crore for CGST and

₹68,561 crore for the SGST.

The revenues for the month of June 2023 are 12% higher than the

GST revenues in the same month last year. During the month, the revenues from

domestic transactions (including import of services) are 18% higher than the

revenues from these sources during the same month last year.

It is for the fourth time, the gross GST collection has crossed

Rs. 1.60 lakh crore mark. The average monthly gross GST collection for the

first quarter of the FY 2021-22, FY 22-23 & FY 23-24 are Rs. 1.10 lakh

crore, Rs. 1.51 lakh crore and Rs. 1.69 lakh crore respectively.

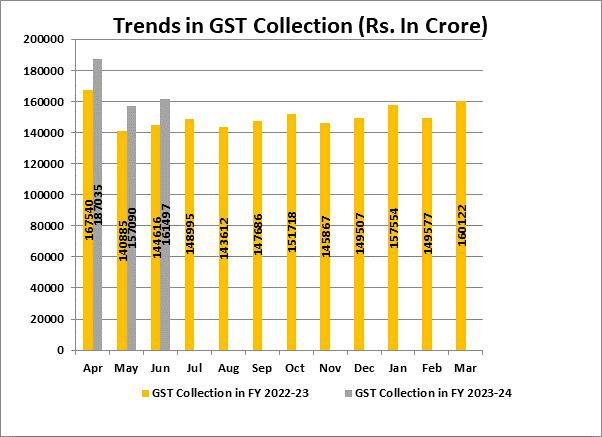

The chart below shows trends in monthly gross GST revenues

during the current year. The table-1 shows the state-wise figures of GST

collected in each State during the month of June 2023 as compared to June 2022

and table-2 shows the SGST portion of the IGST received/settled to the

States/UTs in June’2023.

State-wise growth of GST Revenues during June 2023

|

State

|

Apr-22

|

Apr-23

|

Growth (%)

|

|

Jammu and Kashmir

|

371.83

|

588.68

|

58%

|

|

Himachal Pradesh

|

693.14

|

840.61

|

21%

|

|

Punjab

|

1,682.50

|

1,965.93

|

17%

|

|

Chandigarh

|

169.7

|

227.06

|

34%

|

|

Uttarakhand

|

1,280.92

|

1,522.55

|

19%

|

|

Haryana

|

6,713.89

|

7,988.18

|

19%

|

|

Delhi

|

4,313.36

|

4,744.11

|

10%

|

|

Rajasthan

|

3,385.95

|

3,892.01

|

15%

|

|

Uttar Pradesh

|

6,834.51

|

8,104.15

|

19%

|

|

Bihar

|

1,232.06

|

1,437.06

|

17%

|

|

Sikkim

|

256.37

|

287.51

|

12%

|

|

Arunachal Pradesh

|

58.53

|

90.62

|

55%

|

|

Nagaland

|

33.58

|

79.2

|

136%

|

|

Manipur

|

38.79

|

60.37

|

56%

|

|

Mizoram

|

25.85

|

55.38

|

114%

|

|

Tripura

|

62.99

|

75.15

|

19%

|

|

Meghalaya

|

152.59

|

194.14

|

27%

|

|

Assam

|

972.07

|

1,213.05

|

25%

|

|

West Bengal

|

4,331.41

|

5,053.87

|

17%

|

|

Jharkhand

|

2,315.14

|

2,830.21

|

22%

|

|

Odisha

|

3,965.28

|

4,379.98

|

10%

|

|

Chhattisgarh

|

2,774.42

|

3,012.03

|

9%

|

|

Madhya Pradesh

|

2,837.35

|

3,385.21

|

19%

|

|

Gujarat

|

9,206.57

|

10,119.71

|

10%

|

|

Dadra and Nagar Haveli and

Daman & Diu

|

349.70

|

339.31

|

-3%

|

|

Maharashtra

|

22,341.40

|

26,098.78

|

17%

|

|

Karnataka

|

8,844.88

|

11,193.20

|

27%

|

|

Goa

|

428.63

|

480.43

|

12%

|

|

Lakshadweep

|

0.64

|

21.86

|

3316%

|

|

Kerala

|

2,160.89

|

2,725.08

|

26%

|

|

Tamil Nadu

|

8,027.25

|

9,600.63

|

20%

|

|

Puducherry

|

182.46

|

210.38

|

15%

|

|

Andaman and Nicobar

Islands

|

22.36

|

35.98

|

61%

|

|

Telangana

|

3,901.45

|

4,681.39

|

20%

|

|

Andhra Pradesh

|

2,986.52

|

3,477.42

|

16%

|

|

Ladakh

|

13.22

|

14.57

|

10%

|

|

Other Territory

|

205.3

|

227.42

|

11%

|

|

Center Jurisdiction

|

143.42

|

179.62

|

25%

|

|

Grand Total

|

103317.18

|

121433.52

|

18%

|

|

|

Hope you find it interesting and useful to read. For any clarification/ feedback, feel free to write us at amrg@amrg.in.

Best regards,

AMRG Team

|

|

|

|

About Us

AMRG & Associates is an established Chartered Accountants firm. It came into existence in 1984 and since then has grown its branches across major Indian cities such as Delhi, Mumbai and Chandigarh. Since its inception, it has become one of the leading chartered accountants’ firms in North India. AMRG & Associates offers its clients a wide range of exceptional services through the expertise of its highly motivated group of trained professionals. The firm provides expertise in financial and business advisory, tax and regulatory, audit and assurance and risk advisory services. AMRG & Associates has a client base of 200+ companies & individuals. The firm's approach to service delivery helps to provide value-added services to its wide clientele. Our differentiation is derived from a rapid performance based, industry-tailored and technology-enabled business advisory services delivered by talented professionals in the country.

Corporate office (Delhi, India) : AMRG Tower, 23, Paschim Vihar Extension, Main Rohtak Road, New Delhi -110063, T - 011-47322696 / 97 Branch office (Mumbai, India) : Shop no 14,Adarsh Nagar Bldg No 4,Kolbad, Thane West 400601. Branch office (Sydney, Australia) : Unit 9, 14-15 Junia Avenue, Toongabbie NSW 2146, Sydney, Australia. International Desk (USA) : Wiener & Garg LLC 6000 Executive Boulevard, Suite 520 | Rockville, MD 20852, T - 301.881.4244 | D - 240.833.4002 © -2022 AMRG & Associates All Rights Reserved. This document has been written for the general interest of our clients and professional colleagues and is subject to change. This document is not to be construed as any form of solicitation. It is not intended to be exhaustive or a substitute for legal advice. We cannot assume legal liability for any errors or omissions. Specific advice must be sought before taking any action pursuant to this document.

|

|

|

|

|

|

You are receiving this email because you opted in via our website.

Our mailing address is AMRG Tower, 23, Paschim Vihar Extension, Main Rohtak Road, New delhi-110063 , India |

|

|

|

|